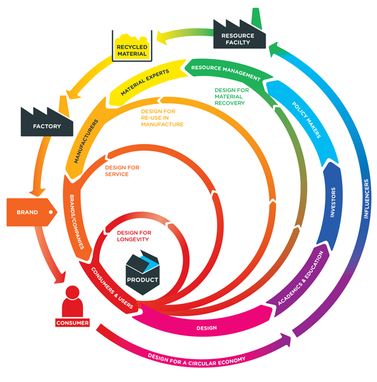

Investigating the Role of Design in the Circular Economy from the Royal Society of the Arts Action and Research Centre [1], explores The Great Recovery Project, an initiative launched in 2012 to build a cross-disciplinary community that is equipped to support the development of an economy based on resource-efficient principles. In the circular economy, products are developed in a cyclical manner, with consideration of the past, present, and future of the fabricated object. Through tear down and build up workshops, exposures to waste management and recycling facilities, and increased dialogue and networking across disciplines, The Great Recovery Project seeks to move production, use, and disposal to a new cyclical structure, embracing the circular economy to lessen our footprint upon the planet.

How can we move to circular thinking with products built upon simple, straightforward means of appropriate second-lives, deconstruction, or discarding? Presently, the Waste & Resources Action Programme (WRAP) estimates that around 540m tonnes of products and materials enter the UK economy each year but only 117m tonnes of this gets recycled. If an equivalent of a mere one-fifth of that which enters the UK economy is recycled, can this hurdle be overcome? Without thinking more holistically about how elements and components can be reused, we face an uncertain future in which valuable waste may be lost to us where it could otherwise be reused.

Are we creating an insurmountable amount of waste? 90 percent of the raw materials which go into making durable products become waste even before the product leaves the factory, and about 80 percent of what is made is discarded within the first 6 months of life. When about 80 percent of a product’s environmental impact is ‘locked in’ at the concept design state, can we shift to thinking about design as a starting point for thinking circularly? Designing products from a circular perspective empowers all levels, from early raw states to post-life break down for reuse. Limiting the product’s impact in the early phases will ultimately save our resources in the long term.

If we stop to consider the life-cycle of a product from early design through to disposal, we can reduce our resource footprint, lessening our impact upon the planet. It is likely that we may need to do so in the decades to come, and that could become the enduring legacy that we pass on to our children.

Kate Burgess-Mac Intosh

© The European Futures Observatory 2013

References:

[1] The full report can be accessed through the following link, along with further information about the RSA Great Recovery Project: http://www.thersa.org/action-research-centre/enterprise-and-design/design/the-great-recovery2

RSS Feed

RSS Feed